Class Notes | Healthcare!

⤏ WRITTEN AND RESEARCHED BY GISSELLE PERNETT AND EDEN HAIN

⤏ EDITED BY CIANA ALESSI AND FAYE ORLOVE

Class Notes is a recurring series exploring topics that we find hard to understand (purposefully or otherwise!). Started as Instagram infographics, Class Notes has shifted into a monthly Jr Hi the Magazine feature which you can read here!

Healthcare terms you should know

We see and hear these important terms all the time, like in those important documents you’re probably avoiding because the envelopes look scary. But what do they actually mean?

What is a premium?

A premium is the fixed amount that you pay to a health insurance organization monthly or annually. Often, premiums are split by employers who help pay for your health coverage and medical expenses. Premiums can range anywhere from $25 to $500. Generally speaking, the more you pay, the better quality and more comprehensive your coverage is in return.

What is a deductible?

A deductible is essentially the amount of money an insured person pays before your insurance will start to cover your expenses. You may have to pay a deductible before a doctor’s visit, surgical operation, or other planned or unexpected medical service. This will usually be a smaller fee than the amount that the insurance provider will pay for. Deductibles are paid in addition to your premium. Lol, no kidding.

LET’S SAY, because of your insurance plan, you have a $1,000 deductible. You have to pay the $1,000 out of pocket BEFORE your insurance kicks in and begins covering costs. After the deductible is paid you could still have to pay copayments.

You know that saying “you have to pay to play”? Premiums are what you pay to play the game, but deductibles are the absolutely mandatory hot dog/soft pretzel/overly priced beer that you need to purchase before you even locate your seat. And the “game” is simply being alive.

WHAT IS A COPAYMENT?

Is it another fee? It’s another fee! This is a fixed amount that is paid for a health care service after you've paid your deductible. The amount you owe as a copayment will vary depending on your insurance coverage and usually correlates directly to how much you pay for your monthly premium. Higher premiums often means lower copayments, and vice versa. Copayments are usually the responsibility of the policy holder. A copayment is paid as a cost-sharing method that assures that you won’t go…to…the…doctor too often? I guess?

OKAY, so you’ve paid (your premium) to enter the game (of good health), you’ve purchased your mandatory pre-game snack (or deductible), and you’re headed to your seat. Finally! You cannot wait to watch a sport (see a doctor!).

Your seat is in sight! But then… the foam finger guy starts walking around yelling out prices. Is a foam finger necessary? In short, yes. In this game, everyone must buy a foam finger, because the foam finger guy is always blocking the aisle where your seat is located. So you buy a foam finger, hoping the dude will move and you can see a doctor, or sorry, watch a sport. Does this analogy still make sense?

What is an HMO?

(No homo). An HMO or a “Health Maintenance Organization” is a type of medical insurance group that provides health services at a premium and specializes in routine care. HMO’s foster the idea that with regular check ups, and symptoms addressed as you come across them, a large (and expensive) medical disaster can be avoided. Oftentimes, HMO’s own and operate their own hospitals and clinics as a cost-saving measure. In Los Angeles, Kaiser Permanente is the most well-known HMO. Side note: saying Permanente makes me feel European even though paying for healthcare doesn’t.

What’s the difference between single payer healthcare and universal healthcare?

Now that you know those terms, let’s talk about what it ACTUALLY means when you have healthcare.

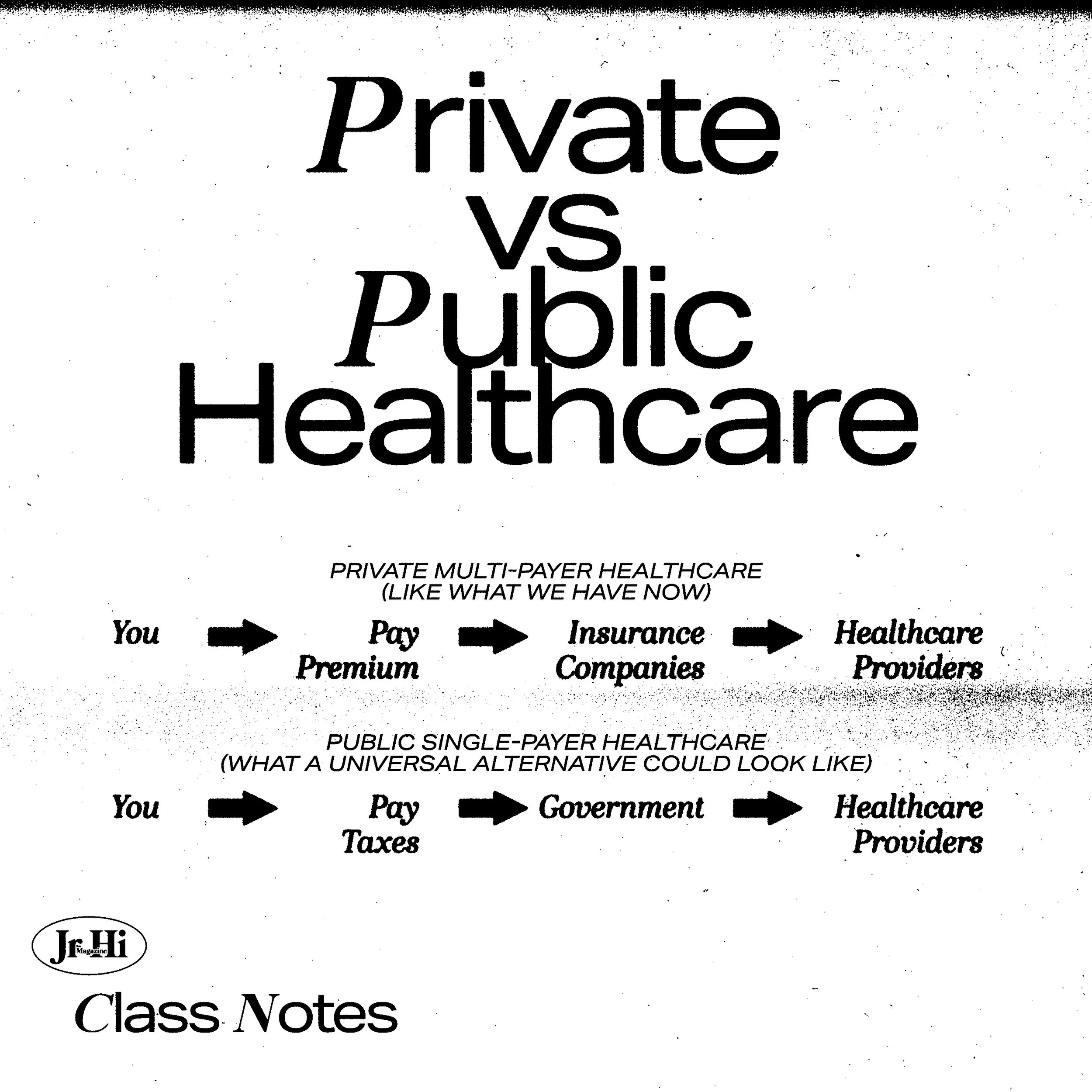

Single payer healthcare is a system where one public organization (like the government) pays for all healthcare costs and fees. A single payer system is funded through taxes and is designed to reduce additional costs like copayments, premiums, and deductibles.

Universal healthcare is a colloquial term, meaning “healthcare should be accessible to everyone without restrictions” (namely: financial security). This can be achieved through single-payer or multi-payer healthcare.

Multiple payer refers to a health system that is financed through more than a single entity, one of which may include government. Private health insurance companies participate in multiple-payer systems, with financing through individual premiums paid directly by beneficiaries, employers, and, in some cases, government.

Right now the United States operates through a multi-payer system, where YOU are responsible for paying for your healthcare along with your insurance company or a Gofundme asking for help to pay for cancer treatment. This is sort of joke, but really not a joke, because according to Gofundme CEO Rob Solomon, “one-third of the donations made through [Gofundme] help people pay for medical care.” If we are crowdsourcing doctor visits the same way we fundraise $2,000 for a midlife crisis squirrel tattoo, maybe? something? is? wrong?

History of the American Healthcare System

This article by George B. Moseley III in the AMA Journal of Ethics does a great job explaining how the system we know today (high premiums, repetitive copays, multi-tiered, etc) came to be.

TLDR; Our CrazySexyCool American healthcare system was essentially developed as a means of keeping hospitals open during the Great Depression. A hundred years ago healthcare was virtually unregulated and health insurance, nonexistent. During the 1920’s, the need for healthcare grew dramatically as did the standards for healthcare professionals. Hospitals became recognized as credible care centers and would pay doctors fixed monthly rates while charging clients low monthly fees. While this gave consumers an affordable way to pay for inpatient care, their “primary purpose was to assure hospitals a steady income stream during a period of declining revenues.”

Blue Cross became known as the first modern health insurance company. They worked with the American Hospital Association and created plans with California state legislation to organize a not-for-profit corporation that provided healthcare while avoiding for-profit insurance regulations.

While this was great for the public — because ya know, the economy sucked — doctors still felt overworked and underpaid. Blue Shield Insurance was founded to cater to doctors’ needs. Blue Shield and Blue Cross began to work in tandem to ensure doctors are paid adequately and people receive medical care.

TLDR to the TLDR: Healthcare is supposed to be people getting care and doctors getting paid for their expertise. Everything else is just added fees.

Healthcare is still inaccessible even for the insured

While 91% of Americans were insured in 2020, copayments, costs of prescription drugs, and missed wages for taking time off work were still too damn high! So, understandably, people started skipping routine doctor visits and not getting immediate treatment. And yes, most people agree that maintaining your health is crucial to our livelihood, but ultimately, healthcare is inaccessible to those with less money.

KFF reports that “substantial shares of adults in the U.S. report difficulty paying for various aspects of healthcare including nearly half who report having difficulty paying for dental care (46%) and a similar share of insured adults who report difficulty affording out-of-pocket costs not covered by their insurance (46%).”

Speaking of the exorbitant prices of receiving healthcare, LET’S TALK ABOUT DRUGS.

Drug pricing

There are no rules for how prices on drugs are set. Not by the government, not by private insurance companies, not by anyone! Your local drug dealers follow more rules on pricing than Big Pharma. Are we advocating for local drug dealers to take over the pharmaceuticals industry? Maybe. Because they do send out very fun emoji-ladden texts during holidays about limited time deals, and the texts we get from CVS when our prescription is ready have exactly zero emojis.

So how is it decided what we pay for the Tretinoin to combat our adult acne?

Pharmaceutical companies develop a drug and set a list price based on the drug’s demand and competition. In order to create demand and generate profit from the drugs, pharmaceutical companies work with pharmacy benefit managers (PBM’s). The prices are then negotiated by the PBM’s on behalf of insurance companies. The goal of the PBM is to make drugs more affordable. The goal of Big Pharma is to make MONEY!

Pharmaceutical companies will pay PBM’s a high rebate in exchange for a higher spot on the insurance companies formulary — a list of prescription drugs covered by the insurance plan. Higher spot on the insurance formulary = more sales for the pharmaceutical company. The PBM then keeps some of the money as commission, and gives the rest to the insurance company.

Drug prices increase because pharmaceutical companies are trying to keep up with the PBM’s demand for high rebates and ensure they are still generating profit. The price increase heavily affects those who are uninsured or people with copays.

The equivalent of this is very similar to how gas is priced these days! While gas prices increase for some vague reasons relating to like the supply chain, or religious persecution, or Joe Biden, or whatever FOX News keeps screaming, we pay the price without question. And we have to! There might be a 10 cent difference at the place two blocks down, but ultimately we’re still powerless to the lack of regulations and we still need gas. Or antidepressants. Or an epipen.

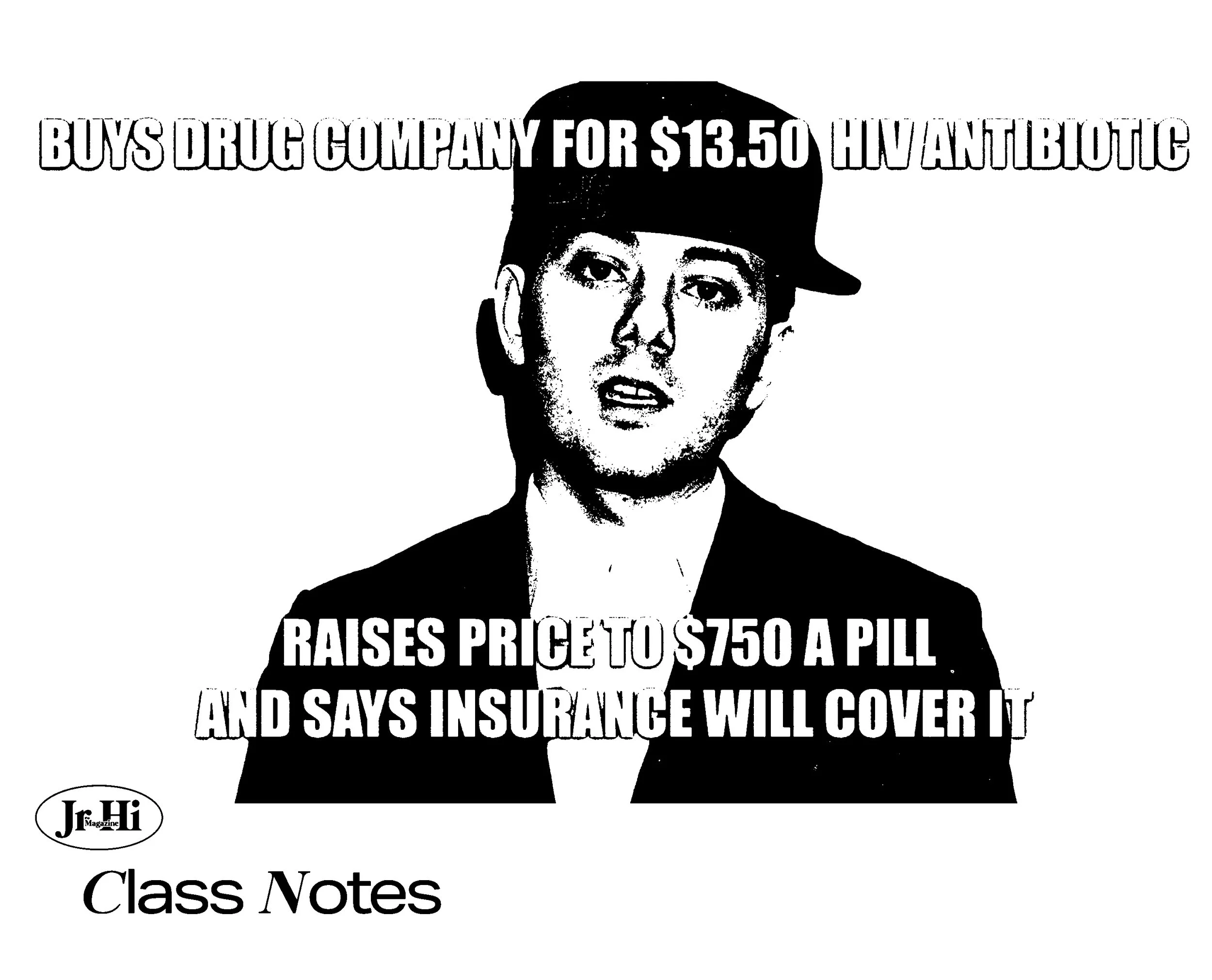

The most egregious case of pharmaceutical companies protecting profit over people is the story of Martin Shkreli — ex-CEO of Turing Pharmaceuticals. Turing Pharmaceuticals held the patent for the drug Daraprim which treats toxoplasmosis, a condition associated with HIV. Since 1953, Daraprim has cost $13.50/per pill. In 2015, when “Pharma Bro” Shkreli got his hands on the patent, he marked up the price to $750/per pill. At the same time, Turing Pharmaceuticals created “anticompetitive restrictions” that ensured no other company could create a generic version with Daraprim’s key ingredient. Fuck that guy. Also team Wu-Tang.

Racism + Healthcare

As if the barriers to obtaining healthcare weren’t already enough, if you’re a person of color, your access to care is likely even worse.

In the last 20 years, the correlation between health issues and commonplace racism has been under investigation. According to the Center for Disease Control, Black people are at higher risk of developing high blood pressure. The CDC found that “psychosocial factors (e.g., effects of racism, social support, access to care) related to high blood pressure control among African American men.”

In addition to sickness being associated with psychological stress, people of color are regularly under-treated by healthcare professionals. The National Library of Medicine reports that, “The attitudes and behaviors of health care providers have been identified as one of many factors that contribute to health disparities” and “Low to moderate levels of implicit racial/ethnic bias were found among health care professionals in all but 1 study.

In a separate study The National Library of Medicine reported that, “in 2014, around 20% of Black adults could not access health insurance compared to 10% in white and Asian adults. For Latinx adults, this figure was 35%. A 2012 study also found that predominantly Black zip codes were 67% more likely to have a shortage of primary care physicians (PCPs).”

About six in ten Black and Hispanic adults (58% each) report delaying or skipping at least one type of medical care in the past year due to cost, compared to half (49%) of White adults.

And *surprise!* most medical resources still cater to white people. A 2012 study done by the University of British Columbia analyzed over 4,000 images in four different medical textbooks and found minimal representation of darker skin tones. When medical textbooks lack diversity, medical professionals cannot be properly trained. Generations of white medical professionals, therefore, can only recognize white people’s symptoms, putting BIPOC individuals at risk for receiving low quality medical attention. High rates of late diagnosis are especially rampant in cancer diagnosis among Black patients.

Racism + Covid

“A May 2020 study estimates that in the U. S., Black people were 3.57 times more likely to die from COVID-19 than white people. Similarly, the risk of death within the Latinx population was nearly twice that of the white population.” This dire statistic is 100% related to access to care, quality of care, and psychosocial factors.

So, racism. Again.

California and Universal Healthcare

California has been trying to pass a single-payer system since 1994 with the introduction of Prop 186.

AB-1400, introduced by San Jose assemblyman Ash Klara, was the most recent bill attempt at single payer universal healthcare. The bill would have established Cal-Care and ensured health protection for EVERYONE. But much like past attempts, AB-1400 did not receive the support it needed to pass the California Assembly.

In conclusion, thanks for getting our hopes up once again California!

What to do when you age out of your parents’ insurance

You are now old, prepare to perish! Just kidding.

The more we research and spiral into Wikipedia rabbit holes, and open so many tabs that our computers are hoisting up their white flags, we still feel confused about what all this means. It feels endless and purposefully confusing. Like no one cares if we live or die???? Hahahah, not my America! But, don’t feel discouraged! Use this as a jumping off point and don’t forget to talk to people. Talk to your friends, your coworkers, your parents, their insurance agent, their insurance agent’s insurance agent! Absorb all the information possible and know you’re not struggling alone. The best way to end the cycle of disinformation is to democratize the information that we do know.

Figure out your options! Find out if you qualify for your employers health insurance plan or your state’s medicaid program.

Know your rights! Before any treatment or appointment, ask for a Good Faith Estimate. The No Surprises Act requires all healthcare professionals to inform you of all expected charges.

Call and write your representatives! Make it known that we’re tired of being unprotected! Eliminate the gap in coverage and make the government CARE ABOUT ALL OF US!